dependent care fsa rollover

2750 in 2021 2850 in 2022. Typically the maximum age for a child.

Medical Fsa Dependent Care Fsa Updates Inside Fp M Uw Madison

For families with two or more children the credit.

. Make dependent care FSA deductions. IR-2021-105 May 10 2021 WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participants child stepchild foster child or tax.

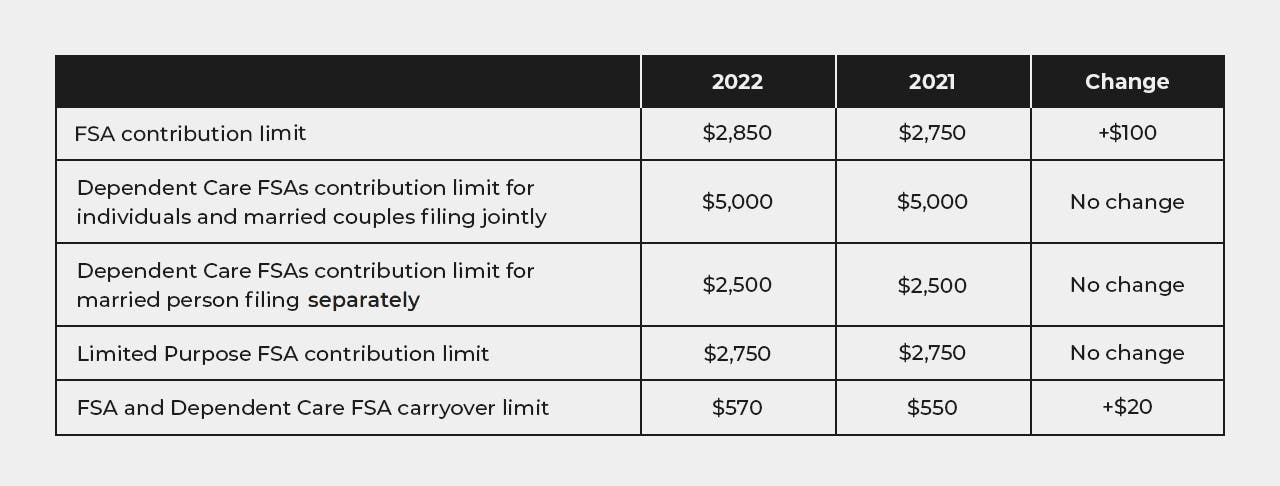

A Dependent Care FSA is a tax-advantaged benefit account offered through an employer. For 2022 the maximum annual contribution for a dependent care FSA is 5000 per household or 2500 if married and filing separately. The FSA has a maximum limit of 2750 for 2021 2850 in 2022.

The most money in 2021 that you can stash inside of a dependent care FSA is 10500. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. Many employees with children or elders who require daytime supervision have no choice but to pay for expensive dependent care services so they can go to work.

The Consolidated Appropriations Act allows for unused DCFSA money to roll over from 2020 to 2021 plans and from 2021 to 2022 plans. If you are divorced only the custodial parent may use a dependent care FSA. Ive contributed 3000 to dependent care FSA in 2020.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. The amount you contribute to your WageWorks Dependent Care FSA cannot be changed during the year unless you experience a change in status or a change in the cost or coverage of. For the 2021 tax year the Child and Dependent Care Tax Credit for a family with one child increased from 3000 to 8000.

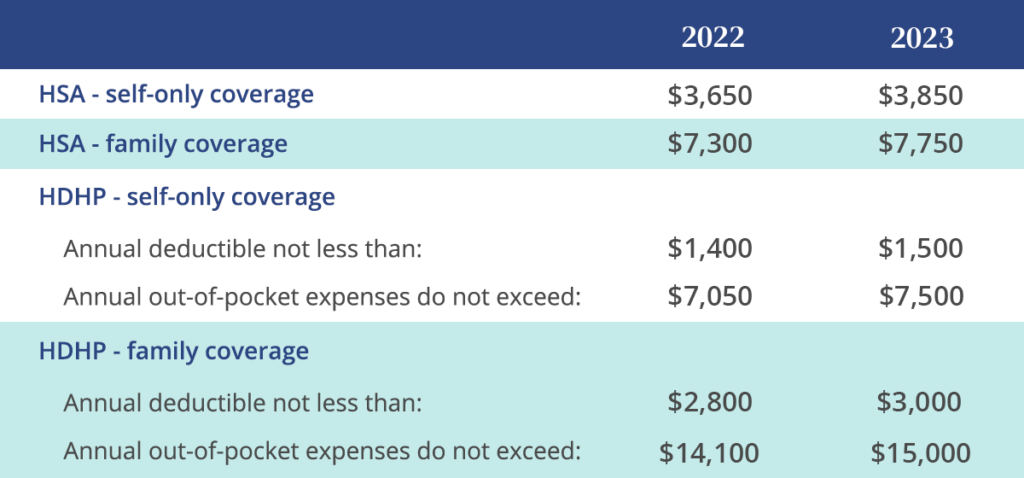

1 The IRS set the 2021 limit for HSAs at 3600 for individual accounts and 7200 for family coverage. The money you contribute to a Dependent Care FSA is not subject to payroll taxes. Companies may allow FSA rollovers into 2022 but.

IRS 2023 Plan Maximums and Limits Dependent Care FSA HSA Participants Partners Transportation Plans May 3rd 2022 by ProBenefits The IRS released the 2023 annual. By signing up for one an employee can contribute up to 5000 annually pre-tax to help cover the. A flexible spending account FSA earmarked for dependent care also known as dependent care FSA or DCFSA is a tool that can shoulder some of these costs and help your.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. The American Rescue Plan increased the 2021 dependent-care flexible spending account limit to 10500 from 5000. The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to be carried over from year to year.

My employer allowed me to carry over the unused balance 2000 to next year based on. Ive paid a 1000 for day care. You can use this money to pay for medical expenses for you your spouse and any dependents which you claim on your tax return.

IRS Clarifies Relief for FSA Carryovers Employers can offer employees participating in health flexible spending accounts FSAs and dependent care FSAs greater flexibility for.

Appropriations Act Permits Midyear Fsa Elections Unlimited Carryover Amounts Through 2021

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Accounts Uk Human Resources

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

Irs Announces 2023 Limits For Hsas Ameriflex

What Is A Dependent Care Fsa Wex Inc

Understanding The Year End Spending Rules For Your Health Account

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post

Flexible Spending Accounts How An Fsa Works Optum Financial Plans

Covid Bill Allows Employers To Temporarily Change Certain Healthcare Fsa And Dependent Care Fsa Rules Sequoia

What Is An Fsa Unitedhealthcare

Fsa And Hsa Limits In 2022 What S Changing Sportrx

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Dependent Care Fsa And Carryover Is Relief Coming Datapath Inc

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More